Scam Awareness Monthly

Learn how to protect yourself from scams, financial fraud, & more!

Investment Scams

Don't let the new year rush get you into an investment scam.

Securing Online Credentials

Spring is the perfect time to refresh your online security habits.

Tax & IRS Scams

Tax scams are on the rise, don't become a victim this tax season.

Scammer Payment Methods

Beware of scammers demanding payment in cryptocurrency, gift cards, or wires.

Tech Support Scams

Don't a let tech support scam throw shade on your summer fun.

Social Media Scams

Social media brings the world to the palm of our hands, and with it--scams.

Mortgage Scams

If you're buying a new home, you may be targeted for a mortgage scam.

Grandparent Scams

Grandparents, look out for scammers impersonating your grandkids this fall.

Lottery Scams

Learn important tips to stay protected against the latest grandparent scams.

Employment Scams

A job offer that seems too good to be true often is.

Phishing Scams

The holiday season is for giving, not for getting phished!

Blackhawk Blog

Donald Millar: Veteran, BHCCU Member, True American

Student Loan Debt Repayment Simplified

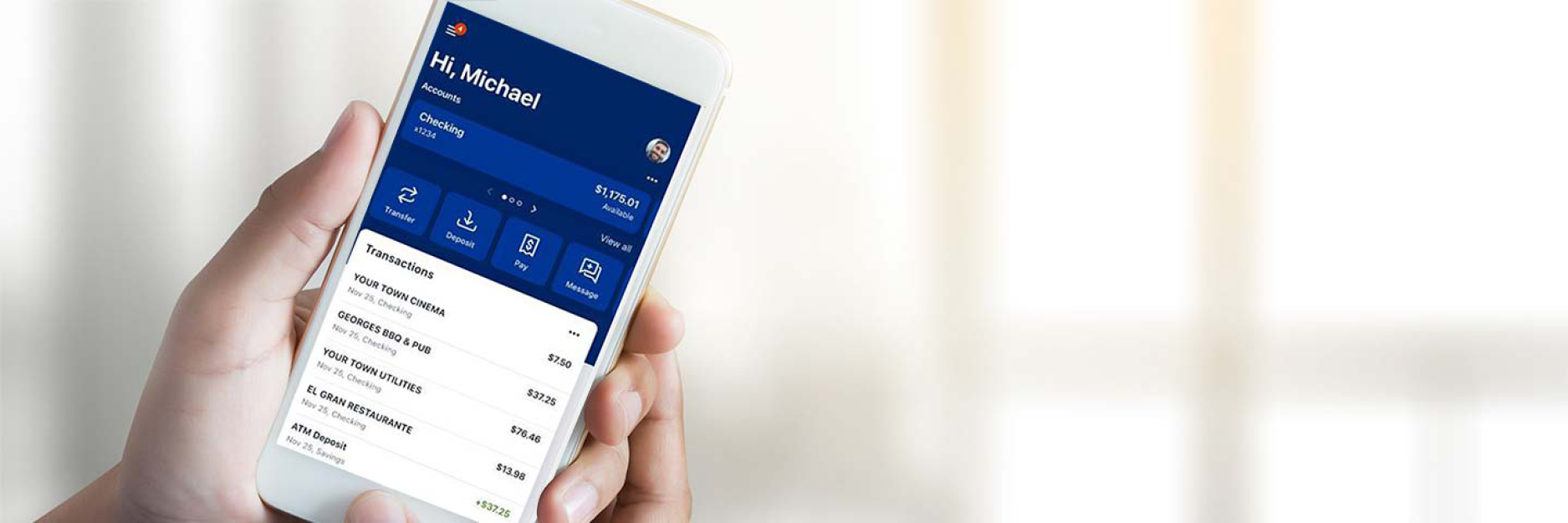

Lock/Unlock your Debit & Credit Cards

February 28, 2020

There have been several reports of fraudulent calls in our area. We will never call to request personal or financial information.

Attention, Attention

Keep up with our latest announcements & updates here!

Community Strong

Festival Street Ribbon Cutting Ceremony

We're a Great Place To Work®!

National Paper Shortage

Protect What Matters Most: YOU

Making Community Giving More Accessible

Child Tax Credit 2021

Important Information for Non-Taxpayers

Empowering our Employees & Future Leaders

Blackhawk Community Credit Union College Scholarships

Blackhawk Community Credit Union & Its Members Support Local Food Pantries this Holiday Season

Did you hear?

We were in the news. Check out some stories below.